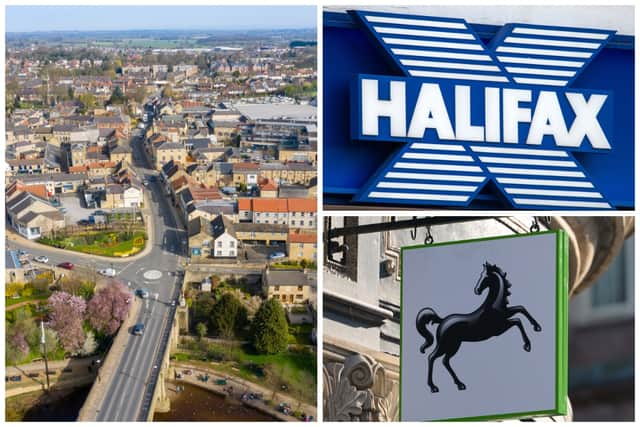

Wetherby: Halifax and Lloyds to close branches as Banking Hub to be set up in Leeds town

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

and live on Freeview channel 276

It was announced this week that Lloyds and Halifax are planning to close their current Wetherby branches in January 2025. The news comes after LINK, the UK’s cash access and ATM network, confirmed that the town will benefit from a new banking hub as part of a wider commitment to protect access to cash.

Banking hubs are a shared banking space, similar to a traditional bank branch, but available to everyone.

Advertisement

Hide AdAdvertisement

Hide AdA Lloyds Banking Group spokesperson: "As many customers now choose to bank through their mobile app or online, visits to our Lloyds Bank and Halifax branches in Wetherby have fallen over recent years.

"Customers can use the local Post Office for everyday banking which is a short walk away from both branches, and access cash at the nearby free-to-use ATMs. Customers can also manage their money online, by calling us, or at the new Banking Hub once it is up and running."

The new hub will consist of a counter service operated by Post Office employees, where customers of any bank can withdraw and deposit cash, make bill payments and carry out regular banking transactions.

There are currently 37 banking hubs up and running in the UK including in nearby Knaresborough. LINK has also recommended a hub in Otley.

Advertisement

Hide AdAdvertisement

Hide AdNick Quin, Head of Financial Inclusion, LINK: "We are pleased to recommend this new banking hub for the local community in Wetherby. Many people are reliant on cash, and it is essential that we protect access to cash and basic banking for communities across the UK."

Councillor Alan Lamb, of the Wetherby ward, has vowed to work alongside Alec Shelbrooke MP in delivering the hub, which it is hoped will see most high street banking facilities return to the town.

If the Banking Hub is not up and running by the listed closure dates of January 13, 2025, Lloyds Banking Group has vowed to keep their branches open for up to 12 months (starting from March 13, 2024) to allow for a smooth transition of banking services in the community.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.