Plans for new vehicle emissions charges in Leeds Clean Air Zone: Everything you need to know

But how much will you have to pay? And what area is going to be affected?

How much will I have to pay to enter the Clean Air Zone in Leeds?

Advertisement

Hide AdAdvertisement

Hide AdCurrently the plan is to introduce a charge of per day for certain types of veicles which are not compliant with the CAZ standard for emissions, which means vehicles registered before 2015.

This would apply only to buses, coaches, HGVs/lorries and taxi and private hire cars and would not affect private motorists, Leeds Council says.

The charges are: Buses/coaches £100 a day, HGVs, £100 a day, taxis £12.50 per day.

What kind of vehicles will be subject to Clean Air Zone (CAZ) charges in Leeds?

Advertisement

Hide AdAdvertisement

Hide AdCurrently only taxis, private hire vehicles, HGVs and buses and coaches.

Only affected vehicles that do not meet minimum engine standards will be charged for entering the CAZ. For HGVs, buses and coaches the required standard will be Euro VI for diesel vehicles and Euro IV for petrol vehicles.

Leeds Council said: "As part of the consultation we will be exploring how we can best achieve the shift of the taxi and private hire fleet to ULEV whether it be via charging any non ULEV or whether simply a robust package of incentives can be relied upon.

"To protect service for vulnerable passengers we will look to exempt Wheel Chair Accessible taxi and private hire vehicles from this requirement."

What areas will be affected?

Advertisement

Hide AdAdvertisement

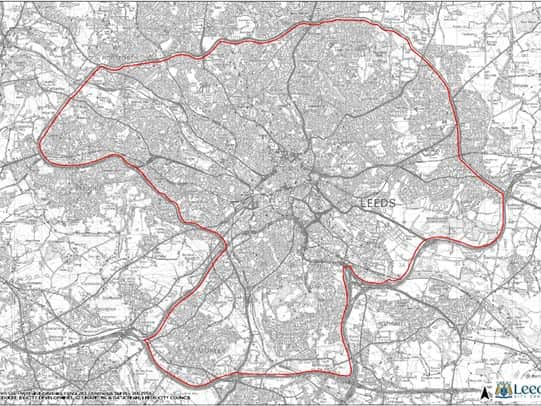

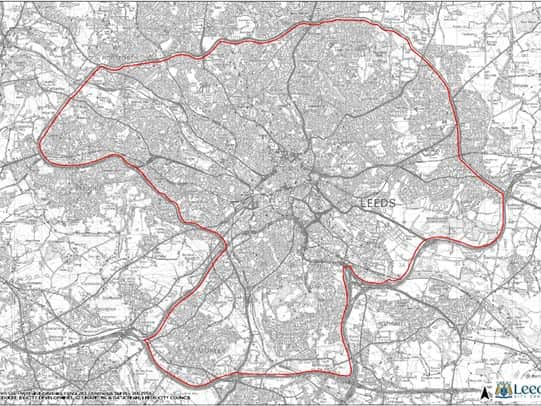

Hide AdSee the image provided by the council for an outline of the zone. Under the draft proposals Morley would fall inside the CAZ but other areas including Pudsey, Horsforth and Rothwell would not. Essentially, anywhere within the Outer Ring Road is included in the Clean Air Zone.

What about businesses/residents living within the Clean Air Zone (CAZ)?

"Leeds City Council is keen for all businesses who travel within the CAZ to feed into the consultation process so their concerns and issues can be reviewed and built into the final CAZ proposal," a spokesman said.

How much is the new Clean Air Zone (CAZ) going to cost Leeds Council to set up?

Advertisement

Hide AdAdvertisement

Hide AdAt this stage the cost has not been finalised, and will not be until the completion of the consultation as this will be key in determining the city’s plans.

Will you get money from the government to help?

Yes – see answer above. The 2017 Autumn Budget also announced an additional £400 million fund for charging infrastructure for electric vehicles.

Where does the money go from charging/ what will it be spent on?

A spokesman said: "The government have issued guidance that a CAZ should not be developed as a revenue stream for local authorities, and that the charge levied should be sufficient to meet the costs of enforcing, administering and maintaining the scheme.

Advertisement

Hide AdAdvertisement

Hide Ad"The government also state that the charge should also be set at a level that will be sufficient to influence enough owners of currently ‘non-compliant’ vehicle to replace their vehicles with a lower emission alternative – thereby delivering a 90% compliance with the scheme.

"Any revenue in excess of the cost of maintaining and administering the scheme will be ring fenced for spending on further measures to improve air quality in Leeds."

When will the Clean Air Zone be implemented?

Within the shortest possible timescale – we will be able to give more detail on timescales once we are closer to submitting a proposal to the government next year.

How many taxis and private hire vehicles are there in Leeds and how many are currently ULEV?

Advertisement

Hide AdAdvertisement

Hide AdLeeds Council has 500 Taxis and over 4000 Private Hire vehicles. 86% of these vehicles are diesel, 6% petrol and the remained 8% are electric hybrid and gas/bio-fuel.

Will Leeds be the first city in UK to introduce a CAZ?

A spokesman said: "Leeds is working hard to deliver the best solution for the city and its residents and visitors to deliver air quality and health improvements in the shortest time possible. London introduced a toxicity charge in October 2017, ahead of a wider Ultra Low Emission Zone (ULEZ) being introduced in 2018. Oxford City Council is also consulting in the implementation of a ULEZ."

Why has the council chosen to introduce a Leeds Clean Air Zone?

According to Leeds Council: "The alternative would be to implement a CAZ D ORR which would affect 59% of the population of Leeds with an estimated 500,000 cars and 120,000 LGVs affected.

Advertisement

Hide AdAdvertisement

Hide Ad"The charge would be likely to hit our poorest communities the hardest as this is where many of the non-compliant cars will be based, leading to inequalities and significant economic impacts."

In the future will there be charges to private cars?

"LCC has focused on delivering compliance as soon as possible without charging private cars to minimise the social and economic impacts of implementing a CAZ. CAZ B with additional measures is modelled to deliver this compliance."

How does it work for emergency services?

Emergency services use a range of specialist and/or novel or adapted vehicles, such as aerial ladders and major incident command vehicles where it may generally not be suitable to provide a replacement vehicle to the standards of the zone. Under the national clean air zone framework these vehicles will be exempt from a charge.

Will Leeds Council's own vehicles be charged?

The charges will be applicable to all vehicles that don’t meet the CAZ standard.

Advertisement

Hide AdAdvertisement

Hide AdWill there be any loans/grants on offer for businesses to help them upgrade fleet?

Existing government grants are in place to assist in the fitting of electric vehicle charging points – OLEV Workplace Grant; Electric Vehicle Home charge Grant and an existing government grant for EV purchases of up to £4,500.

A lifecycle business case for EVs and petrol hybrids shows that over the lifespan of the vehicle, less revenue is required to operate the vehicle due to lower fuel, tax, and maintenance costs.

What is the reaction to the scheme so far?