House price growth regains momentous in June

New figures show that house price growth has regained momentum in June.

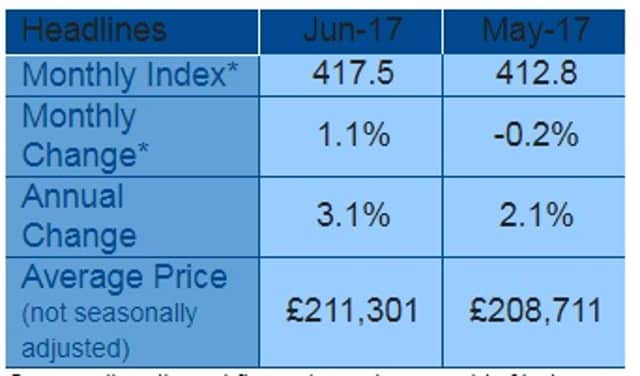

Prices rose 1.1% month-on-month in June, reversing the previous three months’ falls, with annual house price growth rising to 3.1% and the gap in house price growth between strongest and weakest performing regions in Q2 is the smallest on record.

Advertisement

Hide AdAdvertisement

Hide AdCommenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “UK house prices rebounded in June, with prices rising by 1.1% during the month, erasing the decline recorded over the previous three months. However, monthly growth rates can be volatile, even after accounting for seasonal effects.

“The annual rate of house price growth, which gives a better sense of the underlying trend, continues to point to modest price gains. Annual house price growth edged up to 3.1% from 2.1% in May. In effect, after two sluggish months, annual price growth has returned to the 3-6% range that had been prevailing since early 2015.

“There has been a shift in regional house price trends. Price growth in the South of England has moderated, converging with the rates prevailing in the rest of the country. In Q2 the gap between the strongest performing region (East Anglia, which saw 5% annual growth) and the weakest (the North, with 1% growth) was the smallest on record, based on data going back to 1974. Nevertheless, when viewed in levels, the price gap between regions remains extremely wide.

“London saw a particularly marked slowdown, with annual price growth moderating to just 1.2% - the second slowest pace of the 13 UK regions and the weakest pace of growth in the capital since 2012.

Advertisement

Hide AdAdvertisement

Hide AdHow does the uptick in prices accord with other signs of a slowdown?

“The emerging squeeze on household incomes appears to be exerting a drag on housing market activity in recent months. The number of mortgages approved for house purchase has slowed a little in recent months and surveyors report that new buyer enquiries have softened.

“At this point it is unclear whether the increase in house price growth in June reflects strengthening demand conditions on the back of healthy gains in employment and continued low mortgage rates, or whether the lack of homes on the market is the more important factor. While survey data suggests that new buyer enquiries have softened, it also indicates that this has been matched by a decline in new instructions. Indeed, the number of properties on estate agents’ books remains close to all-time lows.

“Given the ongoing uncertainties around the UK’s future trading arrangements, the economic outlook remains unusually uncertain, and housing market trends will depend crucially on developments in the wider economy.

Advertisement

Hide AdAdvertisement

Hide Ad“Nevertheless, in our view, household spending is likely to slow in the quarters ahead, along with the wider economy, as rising inflation squeezes household budgets. This, together with ongoing housing affordability pressures in key parts of the country, is likely to exert a drag on housing market activity and house price growth in the quarters ahead.

“However, the subdued level of building activity and the shortage of properties on the market are likely to provide support for prices. As a result, we continue to believe that a small increase in house prices of around 2% is likely over the course of 2017 as a whole.”