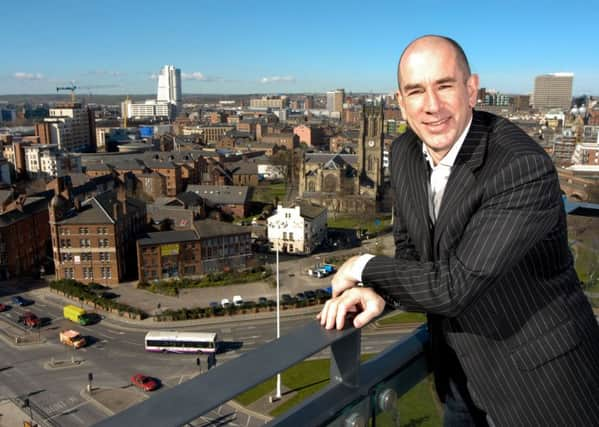

Jonathan Morgan: Building the future in Leeds

The city centre market in Leeds has been starved of supply since 2007 and whilst we had been used to seeing 500 new apartments completing each year, in some years since the downturn, there have been none.

The Government has launched an assault on individual buy to let investors through stamp duty changes and a revised, and detrimental tax regime whilst simultaneously throwing their weight behind an institutional approach to the delivery of properties for rent which they have dubbed ‘PRS’.

Advertisement

Hide AdAdvertisement

Hide AdIt’s an interesting, and slightly confusing approach in the context of a market in which more people are likely to rent for longer and where demand is growing as a consequence of a rising population – we should surely be incentivizing investors to enter the market at all levels.

Institutional PRS is an established North American model which is yet to be delivered in any volume in the UK and there is therefore no evidence to support any assumptions around the depth of the market demand for what is ultimately a premium product.

The huge increase in the number of PRS schemes currently being proposed in the Northern Cities should not be seen as an organic market response but as an opportunistic trend driven not by the availability of cheap money but by the weight of money currently languishing in funds which are unable to generate the necessary returns unless they invest.

There is undoubtedly genuine demand in most Northern Cities for some amenity-rich apartment schemes which offer their residents features such as a concierge, gym, cinema room, lounge and inclusive broadband in return for rents which will need to be around 25 per cent above current market averages in order to deliver a return, but this model should not be seen as the solution to the housing crisis.

Advertisement

Hide AdAdvertisement

Hide AdMost PRS schemes will look and feel broadly the same, many will be designed with close reference to the Government sponsored PRS Handbook and there will be little family friendly product.

We are likely to see a number of PRS schemes come forward in Leeds in the current cycle and there are some real prospects in locations such as the former Yorkshire Post site, City Reach on Kirkstall Road, Quarry Hill, where Caddick Developments are currently considering an element of PRS with sister company MODA Living, and Sweet Street, where it is rumoured that Dandara are gearing up to start construction.

Other schemes such as Green Bank have struggled to secure a fund-backed PRS solution, due mainly to the challenges in delivering a viable build cost and by having to justify premium rents in a location which perhaps doesn’t support this.

Diversity of product type and price is the key to a sustainable city centre market and, alongside a modest PRS offer, we are also going to see some privately funded built to rent schemes such as X1 and East Point, some high quality private schemes such as Iron Works and Tower Works and some innovative and ground-breaking schemes such as Low Fold and Left Bank which will be constructed with sustainability in mind.

Advertisement

Hide AdAdvertisement

Hide AdRental affordability varies enormously across the UK and whilst in London, some tenants are paying away 50 per cent of their salary on their rent, a figure of 30% would be more common in Leeds.

Although this would suggest that there is some headroom in affordability, it is also relevant that a house purchase in Leeds is much more attainable than it is in the south-east and that many renters here will instinctively limit their rental expenditure as much as practically possible in order that they are able to save for a deposit and, historically, due to the lack of real quality in the sector.

The long term single landlord model upon which PRS is built will certainly help to lift the quality of product on offer, but it should not, in our view, be seen as a fundamental solution to the housing supply crisis.