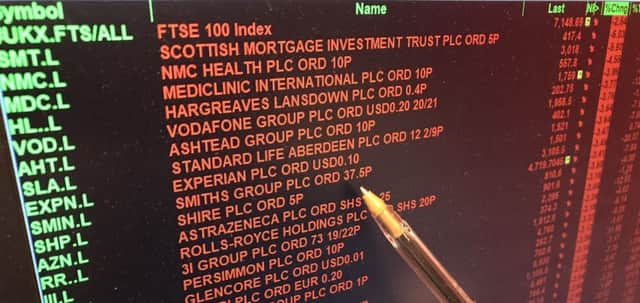

FTSE 100 crashes in early trading as inflation fears rock global markets

The FTSE 100 Index sank by more than 2.5% - hitting its lowest level since late 2016 at 7,079.41 - before paring losses to fall 163.57 points to 7,167.08.

Across Europe, Germany’s Dax plummeted by 2.7% and the Cac 40 in France was languishing 2.1% lower.

Advertisement

Hide AdAdvertisement

Hide AdFalls in Europe followed a brutal overnight sell-off in Asia and on Wall Street, where the Dow Jones Industrial Average and the S&P 500 dropped 4.6% and 4.1% respectively.

Tokyo’s Nikkei 225 Day closed down 4.7%, while the Hong Kong’s Hang Seng Index plunged 5% lower.

The global equity sell-off has been building since last Friday when traders became spooked by the prospect of tighter monetary policy after the US posted strong average earnings data.

The crash follows deep losses during Monday’s session when more than £27 billion was wiped off the value of London’s blue-chip stocks.

Advertisement

Hide AdAdvertisement

Hide AdConnor Campbell, financial analyst at Spreadex, said: “The only hope for the markets at the moment is that investors suddenly decide that the sell-off has been a bit overdone - though in a way it is fitting, matching the astonishing, record-breaking recent rise of the global indices with an equally astounding, heart-stopping drop.

“Admittedly the Bank of England could go some way to allaying investors’ fears of rising interest rates on Thursday, if Mark Carney issues a more dovish statement than forecast.”